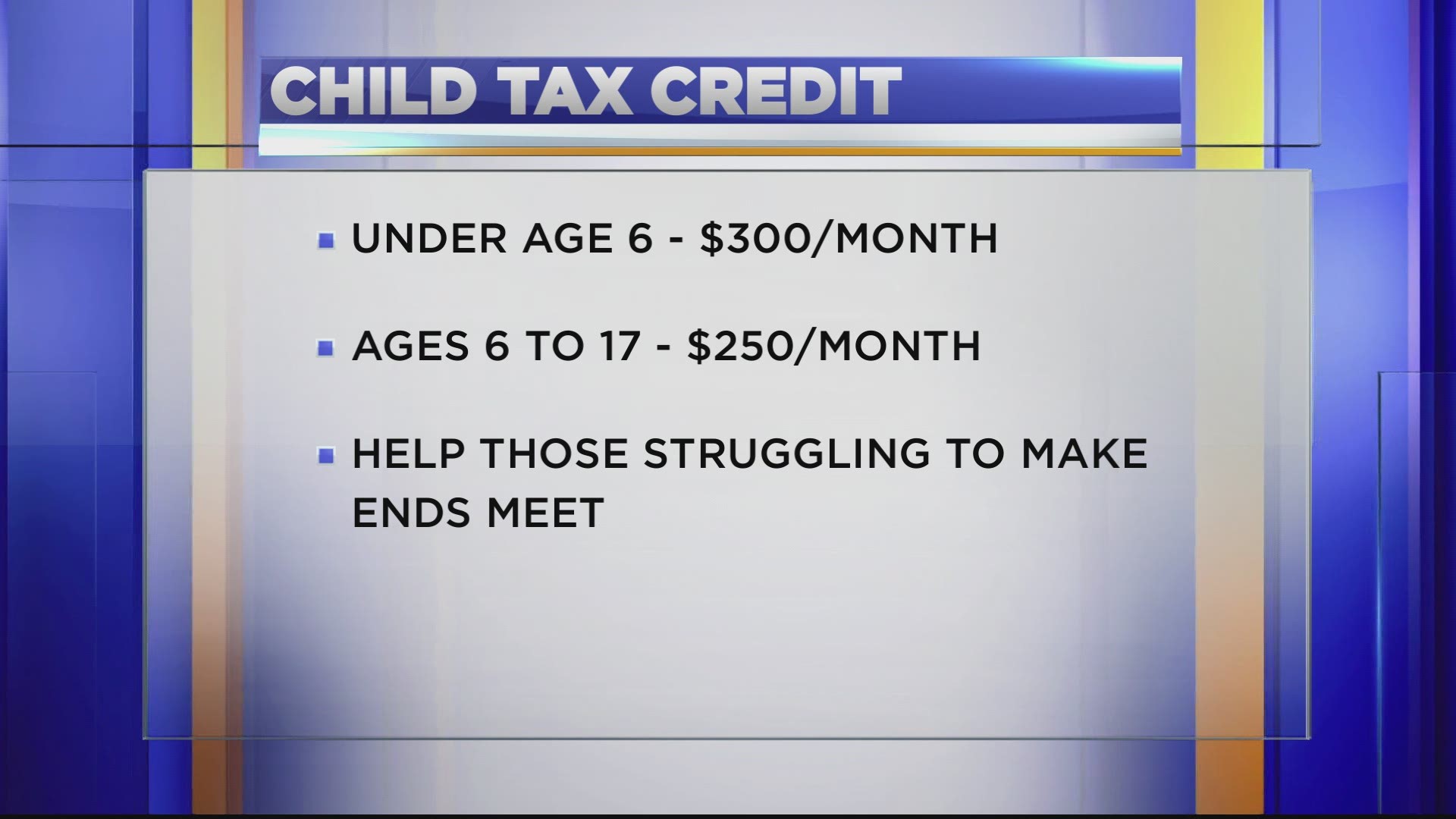

HUNTSVILLE, Ala. — Although we seem to be recovering from the pandemic, there are plenty of people struggling. The American Rescue Plan was signed by President Biden and it includes changes to the Child tax Credit.

The new Child Tax Credit gives guardians $300 a month for kids younger than six and $250 a month for children ages six to 17.

An assistant professor at the University of Alabama at Birmingham (UAB), Peter Jones, Ph.D., says, "This is particularly important for rural areas of Alabama that have persistently high levels of child poverty.”

WZDX News reporter Keneisha Deas spoke with a tax specialist on what parents and taxpayers can expect.

“For 2021 it will be the age 17 and under. It used to be 16 under, but because of the Rescue Plan it’s now 17 and under,” said Roxanne Richardson, an enrolled agent with Blue Accounting, Tax and Consulting.

Richardson encourages people to update their account information.

“You can go on their website and update your information such as your direct deposit information,” she said.

Richardson offered some tips for separated or divorced couples with children.

“Say 2021 one parent was claiming the child and the IRS was basing this credit on who claimed the child in 2020. Well, you know for sure 2021 is coming, you won’t be claiming the child. So you will get those advanced payments if you don’t opt-out and you will have to return that to the IRS,” she said.

And lastly, here’s what you need to know if you should expect to get more or less in taxes:

“Your refund could be less because you are getting part of the refund upfront, or you could owe more in taxes if you’re a person that has a tax due, because now that the credit you normally are used to that would help you to reduce your taxes liability, you’ve received upfront. You’re not going to receive it again on the tax return,” said Richardson.