Scammers are using newer approaches every day to gain personal information from civilians, and older adults are now their newest targets. Financial scams often go unreported or can be difficult to prosecute, so they’re considered a “low-risk” crime, and scammers are moving in on the elderly.

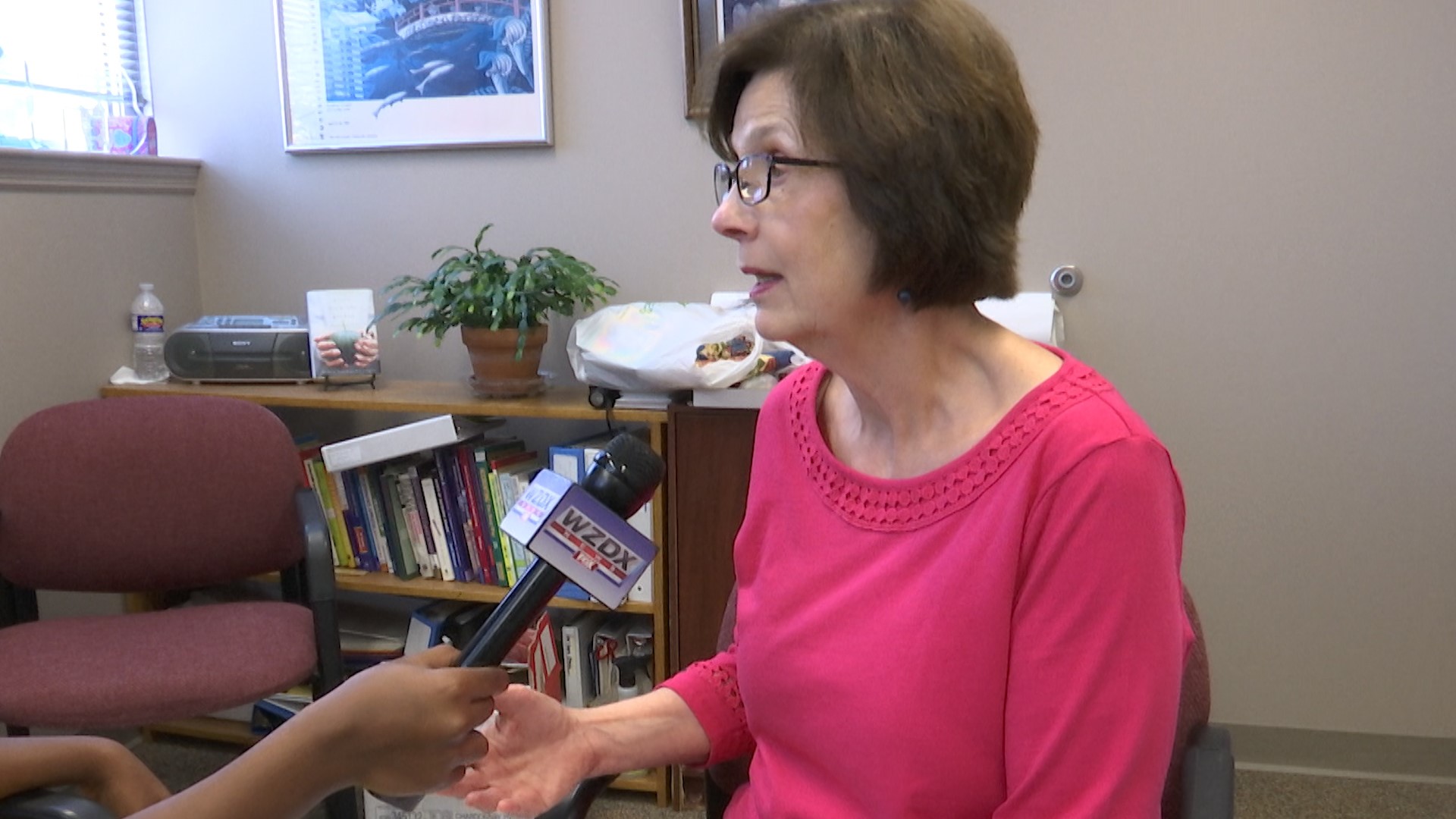

Financial scams against the elderly are considered “the crime of the 21st century”, and perpetrators are rarely caught and prosecuted. We met up with Ann Anderson, Executive Director of CASA of Madison County, a care service for elderly and home-bound citizens in the area. She shared some information on how older adults can protect their information online and over the phone against scammers.

Scammers often call offering fabricated new medical services , tests or screenings provided under Medicare. According to the U.S. Government Accountability Office, Medicare improper payments were estimated to be about $52 billion in 2017.

Anderson says the most important thing for the elderly to remember is to be safe rather than sorry. When asked about unusual phone calls that may come from scammers, she says “We tell our clients to never give out any personal information.”

Scammers target the elderly because they are generally less familiar with technology, have more money in savings and are considered to be more trustworthy than younger targets. Everyone uses social media to connect with family and friends. But, many elderly citizens are falling victim to scammers on social media.

Anderson advises the elderly to think twice before sending money that’s solicited on social media platforms. She says, “If you’ve been on social media and you have someone reaching out to you saying you owe money, please don’t fall for it…”

But, it’s not always strangers who commit these crimes. According to the National Council on Aging “Over 90% of all reported elder abuse is committed by an older person’s own family members, most often their adult children, followed by grandchildren, nieces and nephews, and others.”

But, many family members want to help protect their loved ones from financial fraud and abuse. For those people, Anderson advises checking in with your the older adult in your life, offering to help keep and eye on their finances using digital monitoring, and encouraging them to reach out for help if they receive any suspicious calls or messages demanding money.

If you receive any suspicious calls, emails, or messages from a potential scammer, reach out to the Consumer Financial Protection Bureau, Federal Trade Commission (FTC) or use the Online Complaint Assistant.