If you constantly obsess over your finances, look no further. You are not alone. Nearly 80 percent of people are wrapped up in some type of debt and admit they don’t know how to escape it. According to financial experts, the best way to reduce that stress is by planning.

So when you think ahead, where would you like to financially be by the end of 2020? Do you know how to get there? Beth Douglas with Ameriprise Financial, Inc. says the best way to start planning is by setting small goals.

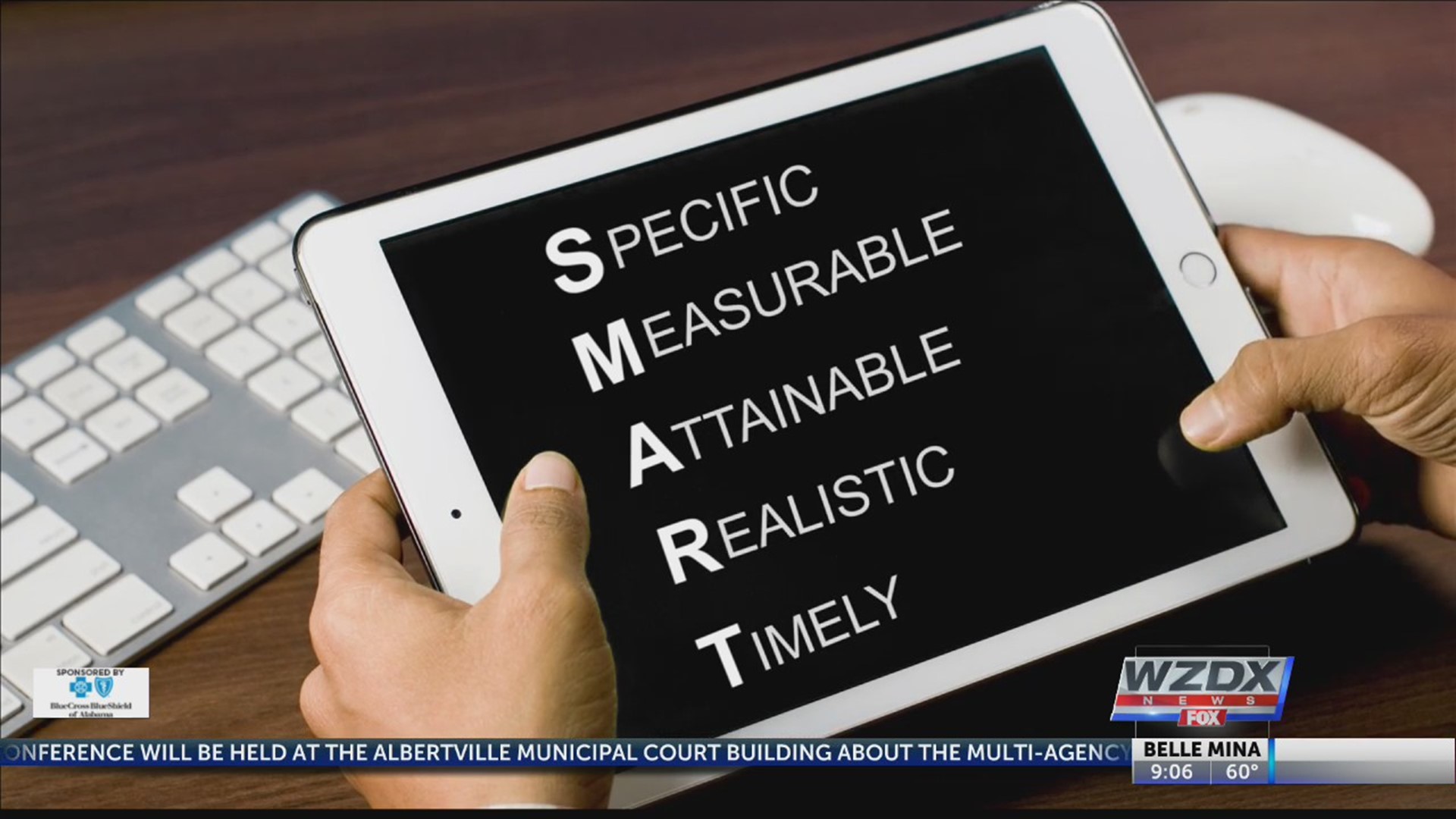

The Las Vegas Review Journal likes to go by the acronym SMART.

-Specific

-Measurable

-Attainable

-Realistic

-Timely

They suggest using this method to set your goals. For example, saying you want to become financially stable by the end of the year is not a SMART goal because it’s vague. A better goal would be to say you want to pay off $3,000 of your student debt by December 2020. That goal is specific, measurable and timely.

Another key short-term goal would be to review your spending, honestly. This step is tough because you must come to terms with the amount of money you truly spend on outside necessities.

“You definitely want to go back and look at that. You’ll be surprised at some of your stuff. I was surprised by my Starbucks spending, so I had to cut that way back,” said Douglas.

Third on the list is to make a budget. The dreaded budget. Many people cringe at this word because no matter how hard you try, it doesn’t always seem to work out as planned. Douglas suggests a little flexibility when creating one, so you can stay focused on your long-term goals.

“Don’t be so strict and really be willing to be flexible because as you set your monthly budget you’re always going to have something that’s going to come up. So you’re going to have to adjust those numbers here or there,” she added.

Another crucial part of long-term success is checking on your credit reports. Often times people don’t see the point in checking on this, but in reality it can make a huge difference.

It’s possible for you to have accounts on your credit report that actually belong to someone with a similar, but different name. Or maybe your dentist office has been sending an unpaid bill to the wrong address, which then has been showing up as delinquent. All of these factors can affect your credit score and hurt you financially.

“That has happened before. Especially if you’re going to get a mortgage or something. It can pull from somebody else’s records,” Douglas said, “But that’s easier to do now, see your credit scores because the banks are providing that as a service for free.”

Last on the list is to come up with a retirement plan, and stick to it!

“Look for tools like a 401k where you have a match and put in at least as much as you can to make that match because that way you’re at least doubling your money going forward.”

A lot of people think they need to match out all the time, but that’s not necessarily the case. If you look at all of your financial goals, you may need to do a certain amount in retirement, but some of those funds could be used for other financial goals.

Celebrate the small goals. Becoming financially educated is something to be proud of and something that will pay off in the long-term. Stay up-to-date with all of your spending’s and savings and you will see success in the future.