MOLINE, Ill. — At the height of the pandemic, the unemployment rate was above 10 percent in Iowa, and nearly 18 percent in Illinois.

That was back in April 2020, but what happened then will impact your taxes now.

Let's face it: 2020 was anything but a normal year. The same could be said for the tax season.

"This is not a normal tax year," said James Fromi.

Fromi is the president of AmeriFile, a tax preparation agency with offices in Moline and Davenport.

Let's start by discussing unemployment income.

"They’re fully taxable unemployment benefits," Fromi said.

You'll receive a specific form, a 10-99G, if you received unemployment income, and that form will outline how much you received. You would receive this form if you were furloughed or lost your job, said Fromi.

What about those two stimulus checks many Americans were eligible for?

"Some people have not received their first one, and some people are still waiting on their second one," said Tameka Toney.

Toney is a tax preparer and accountant in Illinois, and said if you still have not received your stimulus check yet, you can add that to your 2020 tax return.

"You can get what’s called the recovery rebate credit on your tax return," Toney said.

Income received from stimulus checks is not taxable, both Toney and Fromi said.

There's another change in the 2020 tax year to the earned income credit.

"That allows people who made less money in 2020 compared to 2019 to use the income that gets them the most earned income credit," Fromi said.

That could increase your tax refund if you made more in 2019 than in 2020, Fromi said.

"And in many cases so far we’ve added two, three thousand dollars to people’s tax returns because of it," Fromi said.

There are a lot of changes this tax season, but some could give you an even bigger reward.

The IRS delayed its electronic filing start date to February 12, 2021, Fromi and Toney said. That means you can still file your tax return now, but the IRS will not start processing them for refunds until mid-February.

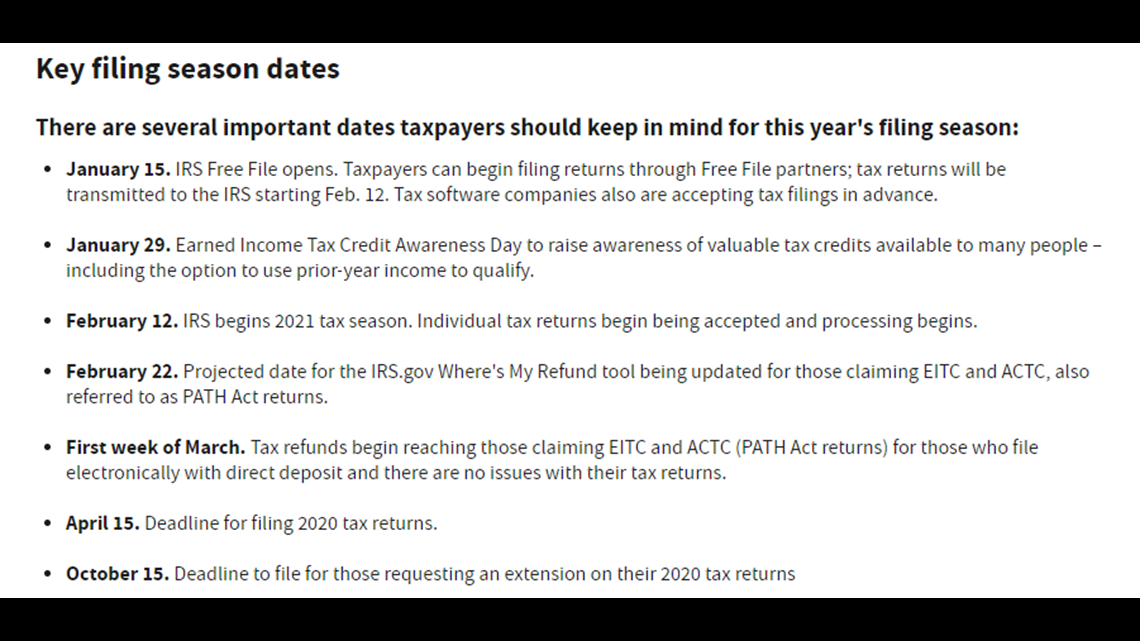

Here are more dates and deadlines, published on the IRS website, as of January 28, 2021.